Bank Code Wells Fargo: Understanding the intricacies of Wells Fargo’s routing numbers and bank codes is crucial for seamless financial transactions. This guide delves into the various aspects of Wells Fargo’s banking codes, from identifying the correct code for specific branches and services to understanding the implications of using incorrect codes and the security measures in place to protect them.

We will explore the different types of codes used across various platforms, the geographical distribution of these codes, and provide practical troubleshooting steps for common issues. Ultimately, our aim is to equip you with the knowledge necessary to navigate the Wells Fargo banking system confidently and securely.

This exploration will cover the purpose and usage of Wells Fargo routing numbers, detailing how they are used in different transaction types such as ACH transfers and wire transfers. We will also examine the potential consequences of using incorrect codes and discuss the importance of verifying authenticity. The guide will also cover security protocols implemented by Wells Fargo to protect its banking codes and provide advice on how customers can protect themselves against fraud.

Finally, we will offer a clear and concise overview of the Wells Fargo banking network’s geographical distribution.

Wells Fargo Routing Numbers: A Comprehensive Overview

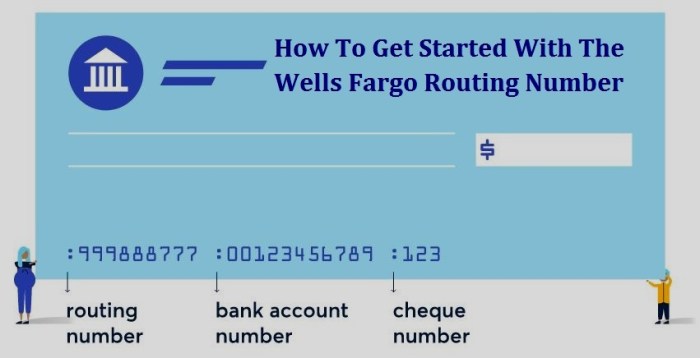

Understanding Wells Fargo routing numbers is crucial for smooth and efficient financial transactions. This routing number, a nine-digit code, acts as a unique identifier for a specific Wells Fargo bank location, directing funds to the correct account. It’s essential for ACH transfers, wire transfers, and other electronic payments.

Wells Fargo Routing Number Examples and Locations

Wells Fargo utilizes various routing numbers depending on the branch location and account type. While a comprehensive list is impractical here, several examples illustrate the diversity.

| Routing Number | Bank Name | Location (State) | Account Type |

|---|---|---|---|

| 121000248 | Wells Fargo Bank, N.A. | California | Personal |

| 121140398 | Wells Fargo Bank, N.A. | Texas | Business |

| 071000016 | Wells Fargo Bank, N.A. | New York | Personal |

Identifying the Correct Wells Fargo Bank Code

Locating the precise Wells Fargo bank code requires careful attention to detail. Several reliable methods ensure accuracy.

Methods for Locating the Correct Bank Code

- Check your Wells Fargo check or bank statement: The routing number is typically printed at the bottom.

- Access your online Wells Fargo account: The routing number is usually visible within account settings or transaction details.

- Contact Wells Fargo customer service: Representatives can provide the correct routing number based on your account information.

- Visit a local Wells Fargo branch: Branch personnel can assist in identifying the appropriate routing number.

Verifying Wells Fargo Bank Code Authenticity

Verifying the authenticity of a Wells Fargo bank code is crucial to prevent errors and fraud. Always cross-reference information from multiple sources.

Sources for Confirming Wells Fargo Bank Codes, Bank code wells fargo

- Official Wells Fargo website

- Wells Fargo mobile banking app

- Wells Fargo customer service

- Your Wells Fargo bank statement

The Importance of Accurate Bank Codes in Transactions

Source: com.ng

Using the correct Wells Fargo bank code is paramount for successful and secure financial transactions. Inaccurate codes lead to delays, rejected payments, and potential financial losses.

Consequences of Incorrect Bank Codes

Incorrect bank codes can result in delayed payments, returned transactions, and fees charged by the sending or receiving institution. In extreme cases, it can lead to significant financial losses or even account security breaches if the incorrect code directs funds to the wrong account.

Understanding the bank code for Wells Fargo is crucial for various financial transactions. If you’re considering alternative banking options, exploring joint account structures is wise, like those offered by cit bank joint account , which offer different features. Returning to Wells Fargo, remember to always verify your bank code with official sources to ensure accuracy in your banking processes.

Impact on Various Transaction Types

The consequences of incorrect bank codes vary depending on the transaction type. For example, an incorrect code in an ACH transfer may cause the payment to be rejected, while an incorrect code in a wire transfer might lead to delays and additional fees. The impact is generally more significant for larger transactions.

Variations in Wells Fargo Bank Codes Across Different Services

Wells Fargo might use different routing numbers for various services; however, this is less common than variations based on branch location. Consistency is generally prioritized to minimize confusion.

Wells Fargo Bank Codes Across Services

| Service Type | Bank Code (Example – May Vary) | Notes |

|---|---|---|

| Online Banking | Same as check routing number | Generally consistent with other services. |

| Mobile Banking | Same as check routing number | Generally consistent with other services. |

| Wire Transfers | May vary slightly depending on the receiving bank | Always verify with the receiving institution. |

Security Measures Related to Wells Fargo Bank Codes: Bank Code Wells Fargo

Source: bankcheckingsavings.com

Wells Fargo employs robust security measures to protect its bank codes and prevent fraud. These measures safeguard both the bank and its customers.

Wells Fargo’s Bank Code Security Protocols

Wells Fargo uses encryption and other security protocols to protect its bank codes from unauthorized access and misuse. They regularly monitor for suspicious activity and implement fraud prevention measures.

Protecting Yourself from Bank Code-Related Fraud

- Never share your routing number or account information with unsolicited parties.

- Be cautious of phishing scams and emails requesting your banking details.

- Regularly review your bank statements for unauthorized transactions.

- Report any suspicious activity to Wells Fargo immediately.

Troubleshooting Issues with Wells Fargo Bank Codes

Problems with Wells Fargo bank codes are usually easily resolved. Following a systematic approach is key to efficient troubleshooting.

Troubleshooting Incorrect Bank Code Entries

Double-check the routing number against your bank statement or online banking information. Contact Wells Fargo customer service if the problem persists.

Visual Representation of Wells Fargo’s Banking Network

Wells Fargo’s extensive network spans across the United States, with a high concentration of branches in major metropolitan areas and coastal regions. Routing numbers reflect this geographical distribution, with variations based on region and branch location. While a detailed map is not provided here, imagine a map showing a denser concentration of branches and associated routing numbers in major cities such as New York, Los Angeles, Chicago, and San Francisco, gradually thinning out towards less populated areas.

Regional variations are noticeable, with different routing number ranges being associated with different states and regions. For example, the western states might have a different range of routing numbers compared to the eastern states.

Closure

Navigating the world of Wells Fargo bank codes may seem complex, but with a clear understanding of their purpose, usage, and security implications, you can ensure smooth and secure financial transactions. Remember to always verify the accuracy of your bank codes before initiating any transfer, and familiarize yourself with the resources available for resolving any issues you may encounter.

By utilizing the information and advice provided in this guide, you can confidently manage your Wells Fargo banking interactions, minimizing risks and maximizing efficiency.