How to open a TD Bank checking account is a question many prospective customers grapple with. Navigating the process, from understanding eligibility requirements to managing the account securely, requires careful consideration. This exploration delves into the intricacies of opening a TD Bank checking account, examining the various methods, required documentation, account types, fees, and security measures involved. We aim to provide a comprehensive guide, shedding light on the often-overlooked details and potential pitfalls.

This analysis goes beyond a simple step-by-step guide, critically evaluating the advantages and disadvantages of different approaches, comparing account options, and highlighting the importance of understanding associated fees and security protocols. The goal is to empower potential customers with the knowledge necessary to make informed decisions and avoid common mistakes.

Eligibility Requirements for a TD Bank Checking Account: How To Open A Td Bank Checking Account

Opening a TD Bank checking account requires meeting specific eligibility criteria. Understanding these requirements ensures a smooth and efficient application process. Failure to meet these criteria may result in application rejection.

So, you wanna open a TD Bank checking account, ya? Easy peasy, lemon squeezy! But say you need to, like, transfer some duit from your Cit Bank account first? Check out these cit bank wire transfer instructions to make sure it’s all smooth sailing. Then, bam, back to opening that TD account – you’ll be swimming in rupiah in no time, eh?

Minimum Age and Residency Requirements

Generally, you must be at least 18 years old to open a TD Bank checking account independently. In some cases, minors may be able to open accounts with a parent or guardian as a joint account holder. Residency requirements typically necessitate proof of address within the United States, specifically within a region served by TD Bank. Specific requirements may vary based on account type and location.

Required Identification Documents

To verify your identity and residency, TD Bank requires specific documentation. Providing accurate and complete documentation is crucial for a successful application.

- Government-issued photo ID (driver’s license, passport, state ID card)

- Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Proof of address (utility bill, bank statement, lease agreement)

Credit Score and Financial History

While a good credit score isn’t typically required to open a standard checking account, TD Bank may review your financial history for risk assessment, particularly for accounts with higher limits or special features. A history of financial responsibility can enhance your application.

Account Opening Methods

TD Bank offers convenient methods for opening a checking account: online or in person at a branch. Each method has its own advantages and disadvantages.

Opening an Account Online

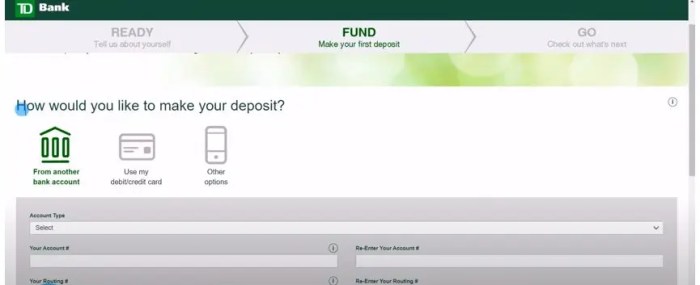

Opening a TD Bank checking account online is a fast and convenient process. The following steps Artikel the typical procedure:

| Step | Action | Details | Time Estimate |

|---|---|---|---|

| 1 | Visit the TD Bank website | Navigate to the “Open an Account” section. | 1-2 minutes |

| 2 | Select Account Type | Choose the checking account that best suits your needs. | 2-3 minutes |

| 3 | Complete Application | Provide personal information, address, and other required details. | 10-15 minutes |

| 4 | Verify Identity | Upload required identification documents. | 5-10 minutes |

Opening an Account In Person at a Branch

Opening an account in person allows for direct interaction with a bank representative. This method is beneficial for those who prefer personalized assistance.

- Visit a local TD Bank branch.

- Speak with a bank representative to discuss your checking account options.

- Complete the necessary paperwork and provide required documentation.

- Fund your new account.

Comparison of Online and In-Person Methods

Online account opening offers speed and convenience, while in-person opening provides personalized assistance and immediate account access. The choice depends on individual preferences and needs.

Advantages and Disadvantages

Online methods are faster and more convenient, but lack the personal interaction of in-person methods. In-person methods offer personalized assistance but may require more time and travel.

Required Documentation

Accurate and complete documentation is essential for successful account verification. The following documents are typically required.

List of Necessary Documents

The specific documents required may vary slightly, but generally include:

- Government-issued photo ID (driver’s license, passport, state ID card)

- Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Proof of address (utility bill, bank statement, lease agreement)

Purpose of Each Document

These documents are used to verify your identity, confirm your residency, and comply with Know Your Customer (KYC) regulations.

Sample Document Checklist

Use this checklist to ensure you have all necessary documents before visiting a branch or applying online.

- [ ] Government-issued photo ID

- [ ] Social Security number (SSN) or ITIN

- [ ] Proof of address (utility bill, bank statement, lease agreement)

Document Preparation

Ensure all documents are clear, legible, and valid. Copies should be clear and easily readable.

Types of TD Bank Checking Accounts

TD Bank offers various checking accounts to cater to different customer needs and financial profiles. Understanding the features of each account helps you choose the best option.

TD Bank Checking Account Types

TD Bank typically offers several checking account options, each with its own set of features, fees, and benefits. These may include basic checking, interest-bearing checking, and accounts with higher minimum balance requirements.

| Account Type | Monthly Fee | Minimum Balance | Interest Rate |

|---|---|---|---|

| Basic Checking | $0-$10 (depending on the specific account) | $0 | 0% |

| Interest-Bearing Checking | $0-$10 (depending on the specific account) | $500-$1000 (depending on the specific account) | Variable, typically low |

| Premier Checking | $0-$25 (depending on the specific account) | $1000-$2500 (depending on the specific account) | Variable, typically higher |

Target Customer Profiles

Source: busconomico.us

Basic checking is ideal for those with minimal banking needs. Interest-bearing checking is suitable for those who want to earn interest on their balances. Premier checking caters to customers with higher balances and banking needs.

Fees and Charges

Understanding the fee structure associated with your chosen TD Bank checking account is crucial for effective financial management. Unforeseen fees can impact your budget.

Monthly Maintenance Fees

Monthly maintenance fees vary depending on the specific checking account type. Some accounts may waive fees if minimum balance requirements are met.

Overdraft Fees and Other Charges

Overdraft fees are charged when you spend more money than you have in your account. Other potential charges may include fees for using out-of-network ATMs or for specific transactions.

Examples of Fee Scenarios, How to open a td bank checking account

Overdraft fees can be substantial. A common scenario is writing a check or making a purchase that exceeds your available balance. ATM fees may apply when using ATMs not affiliated with TD Bank.

Fee Comparison Table

| Account Type | Monthly Fee | Overdraft Fee | ATM Fee (Out-of-Network) |

|---|---|---|---|

| Basic Checking | $5 | $35 | $2.50 |

| Interest-Bearing Checking | $10 | $35 | $2.50 |

| Premier Checking | $0 (with minimum balance) | $35 | $2.50 |

Account Management and Access

TD Bank provides multiple convenient methods for managing your checking account and accessing your funds. Utilizing these methods ensures efficient account management.

Accessing Account Information

You can access your account information through online banking, the mobile app, or phone banking.

Setting Up Online and Mobile Access

Enroll in online banking and download the TD Bank mobile app to manage your account conveniently. Follow the instructions provided on the TD Bank website or app.

Managing Account Settings

You can manage your account settings, such as adding beneficiaries or updating contact information, through online banking or by contacting customer service.

Mobile Check Deposit

Use the mobile banking app to deposit checks remotely. Follow the app’s instructions to take a picture of your check and submit it for deposit.

Security Measures

TD Bank employs robust security measures to protect your account information and funds. Understanding these measures helps you protect yourself from fraud.

TD Bank Security Measures

TD Bank utilizes advanced encryption and fraud detection systems to safeguard your accounts. They regularly update their security protocols to stay ahead of emerging threats.

Reporting Lost or Stolen Cards

Immediately report lost or stolen debit cards to TD Bank’s customer service to prevent unauthorized transactions.

Identifying and Avoiding Phishing Scams

Be wary of suspicious emails or text messages requesting your account information. TD Bank will never ask for your password or personal information via email or text.

Best Practices for Account Security

Source: thesmartinvestor.com

Use strong passwords, regularly monitor your account activity, and be cautious about sharing your personal information online.

Customer Service and Support

TD Bank offers various customer support channels to assist you with your banking needs. Understanding these options helps you get timely assistance.

Customer Support Channels

You can contact TD Bank customer service via phone, email, or in-person at a branch.

Contacting Customer Support

Visit the TD Bank website or app for contact information and instructions on how to reach customer service.

Contact Information

Specific contact information can be found on the TD Bank website or app. This usually includes phone numbers, email addresses, and branch locations.

Typical Response Times

Response times vary depending on the chosen method. Phone support typically offers the fastest response, while email may take longer.

End of Discussion

Opening a TD Bank checking account, while seemingly straightforward, involves a nuanced process demanding careful attention to detail. From understanding eligibility criteria and selecting the appropriate account type to navigating the online or in-person application process and comprehending associated fees and security measures, informed decision-making is crucial. This analysis has aimed to illuminate these critical aspects, empowering readers to confidently navigate the process and manage their accounts effectively.

Ultimately, the success of this endeavor hinges on a proactive approach to understanding the terms and conditions, and utilizing available customer support resources when needed.